Weighted Average Cost Of Closing Inventory . Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. The cost of goods sold is $13,820, calculated as: Any time goods are removed. Web the closing inventory value is $4,810. Every time units are added, a new average price is calculated. Web cumulative weighted average. Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold.

from fity.club

Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web the closing inventory value is $4,810. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Web cumulative weighted average. Weighted average inventory is the costing method that allocated equal cost to all inventory. Any time goods are removed. Every time units are added, a new average price is calculated. Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. The cost of goods sold is $13,820, calculated as: Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing.

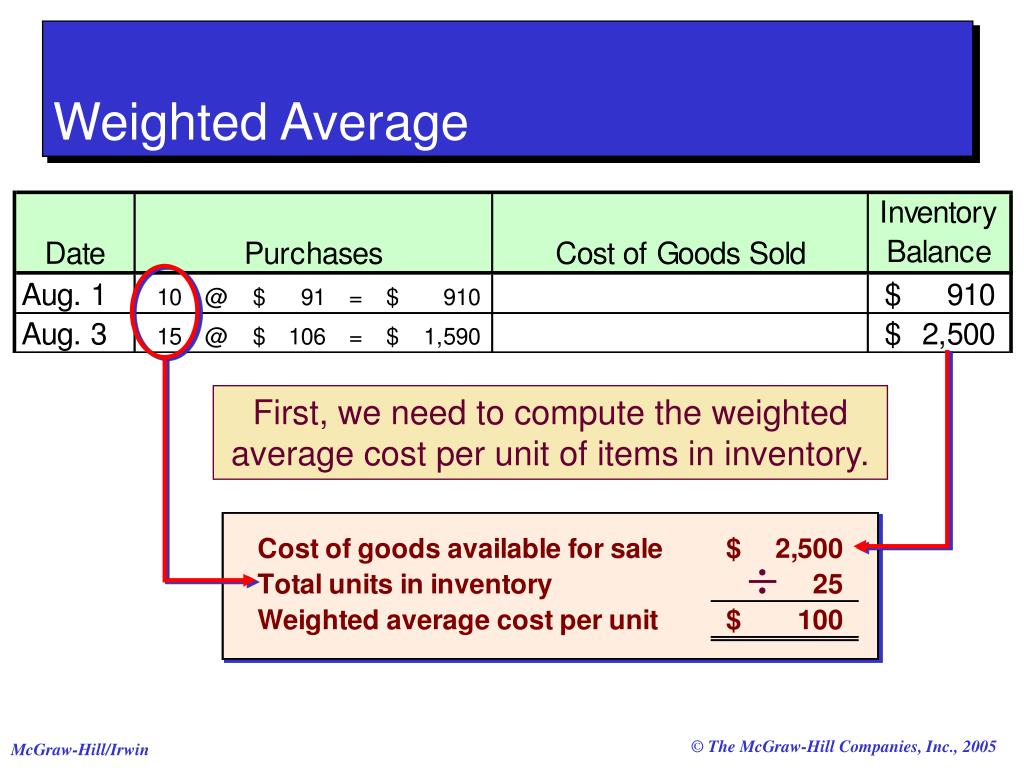

Weighted Average

Weighted Average Cost Of Closing Inventory Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web cumulative weighted average. The cost of goods sold is $13,820, calculated as: Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Any time goods are removed. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Every time units are added, a new average price is calculated. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the closing inventory value is $4,810. Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing.

From slideplayer.com

F2 Management Accounting ppt download Weighted Average Cost Of Closing Inventory Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Weighted average inventory is the costing method that allocated equal cost to all inventory. The cost of goods sold is $13,820, calculated as: Every time units are added, a new average price is calculated. Web the weighted average cost. Weighted Average Cost Of Closing Inventory.

From www.asprova.jp

Weighted Average Method Inventory Control MRP glossary of Weighted Average Cost Of Closing Inventory Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the closing inventory value is $4,810. Web cumulative weighted average. Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. Web the weighted average cost formula is used in accounting to calculate the average cost of. Weighted Average Cost Of Closing Inventory.

From www.bartleby.com

SPECIFIC IDENTIFICATION, FIFO, LIFO, AND WEIGHTEDAVERAGE bartleby Weighted Average Cost Of Closing Inventory The cost of goods sold is $13,820, calculated as: Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the closing inventory value is $4,810. Web the weighted average cost formula is used in accounting to calculate. Weighted Average Cost Of Closing Inventory.

From www.vrogue.co

How To Find Ending Inventory Using Weighted Average vrogue.co Weighted Average Cost Of Closing Inventory The cost of goods sold is $13,820, calculated as: Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Web the weighted average cost method is. Weighted Average Cost Of Closing Inventory.

From www.coursehero.com

[Solved] 3. Using weightedaverage cost, calculate ending inventory Weighted Average Cost Of Closing Inventory Web cumulative weighted average. Web the closing inventory value is $4,810. Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. Any time goods are removed. Weighted average inventory is the costing method that allocated equal cost to all inventory. The cost of goods sold is $13,820, calculated as: Every time. Weighted Average Cost Of Closing Inventory.

From www.youtube.com

Inventory costing Weighted Average, Periodic YouTube Weighted Average Cost Of Closing Inventory Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Every time units are added, a new average price is calculated. Web the weighted average cost formula is used in accounting to calculate the average. Weighted Average Cost Of Closing Inventory.

From courses.lumenlearning.com

The Weighted Average Method Accounting for Managers Weighted Average Cost Of Closing Inventory Web the closing inventory value is $4,810. Web cumulative weighted average. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Any time goods are removed. Every time units. Weighted Average Cost Of Closing Inventory.

From www.slideserve.com

PPT Inventory Management PowerPoint Presentation, free download ID Weighted Average Cost Of Closing Inventory Web cumulative weighted average. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Every time units are added, a new average price is calculated. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. The. Weighted Average Cost Of Closing Inventory.

From exoeweqfa.blob.core.windows.net

Average Cost Of Ending Inventory at Ivan Robertson blog Weighted Average Cost Of Closing Inventory Any time goods are removed. Web the closing inventory value is $4,810. The cost of goods sold is $13,820, calculated as: Web cumulative weighted average. Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Every time units. Weighted Average Cost Of Closing Inventory.

From flow.space

Inventory Weighted Average Cost Formula & More Flowspace Weighted Average Cost Of Closing Inventory Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. The cost of goods sold is $13,820, calculated as: Web the closing inventory value is $4,810. Any time goods are removed. Web the weighted average. Weighted Average Cost Of Closing Inventory.

From support.accountingseed.com

Inventory Valuation Weighted Average Cost Accounting Seed Knowledge Weighted Average Cost Of Closing Inventory Every time units are added, a new average price is calculated. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Web the closing inventory value is $4,810. Web cumulative weighted average. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates. Weighted Average Cost Of Closing Inventory.

From www.chegg.com

Solved Calculate the weighted average cost of the following Weighted Average Cost Of Closing Inventory The cost of goods sold is $13,820, calculated as: Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Weighted average inventory is the costing method that allocated equal cost to all inventory. Any time goods are removed. Web the weighted average cost method is one of three approaches. Weighted Average Cost Of Closing Inventory.

From www.youtube.com

Calculating ending inventory using the LIFO method YouTube Weighted Average Cost Of Closing Inventory Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Any time goods are removed. Every time units are added, a new average price is calculated. Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. Web cumulative. Weighted Average Cost Of Closing Inventory.

From www.bartleby.com

Answered 1. Calculate cost of ending inventory… bartleby Weighted Average Cost Of Closing Inventory The cost of goods sold is $13,820, calculated as: Weighted average inventory is the costing method that allocated equal cost to all inventory. Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Web cumulative weighted average. Web one widely used method is the weighted average cost (wac) method, which provides a. Weighted Average Cost Of Closing Inventory.

From quentinyouthchristensen.blogspot.com

How to Calculate Closing Inventory Weighted Average Cost Of Closing Inventory Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. The cost of goods sold is $13,820, calculated as: Weighted average inventory is the costing method that allocated equal cost. Weighted Average Cost Of Closing Inventory.

From www.shiprocket.in

What is the Average Weighted Method & Its Significance? Shiprocket Weighted Average Cost Of Closing Inventory The cost of goods sold is $13,820, calculated as: Every time units are added, a new average price is calculated. Web the closing inventory value is $4,810. Any time goods are removed. Web the main difference among weighted average, fifo, and lifo accounting is how each calculates inventory and cost of goods sold. Web cumulative weighted average. Web the weighted. Weighted Average Cost Of Closing Inventory.

From fity.club

Weighted Average Weighted Average Cost Of Closing Inventory Web one widely used method is the weighted average cost (wac) method, which provides a balanced approach to valuing. Every time units are added, a new average price is calculated. Web the weighted average cost formula is used in accounting to calculate the average cost of inventory items over a period of time. Weighted average inventory is the costing method. Weighted Average Cost Of Closing Inventory.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation, free download ID6421395 Weighted Average Cost Of Closing Inventory Weighted average inventory is the costing method that allocated equal cost to all inventory. The cost of goods sold is $13,820, calculated as: Every time units are added, a new average price is calculated. Any time goods are removed. Web the weighted average cost method is one of three approaches of valuing your businesses inventory stock and. Web cumulative weighted. Weighted Average Cost Of Closing Inventory.